I’m going to say this loud for the people in the back:

If you own a business and you’re still handing out your Social Security number, we need to fix that. Immediately.

This comes up every single year around 1099 season. Service providers panic. Business owners avoid W-9 requests. Everyone’s nervous about sending sensitive info through email like it’s no big deal.

It is a big deal.

And the solution is stupid simple.

What an EIN Actually Is (and Why You Need One)

An EIN (Employer Identification Number) is basically a Social Security number for your business.

And before you say, “But I’m just a sole prop” or “I don’t have employees” — stop. That doesn’t matter.

If you:

- Provide services

- Get paid by clients

- Receive (or should receive) 1099s

You should have an EIN.

Why? Because you should never be emailing your Social Security number to clients, bookkeepers, or accountants if you don’t have to. Period.

W-9s + 1099s: Here’s How This Actually Works

When you do work for someone, they are responsible for issuing you a 1099 (if applicable).

To do that, they need a W-9 from you.

That W-9 includes:

- Your legal name

- Your business name (if applicable)

- A tax ID number

That tax ID number can be:

- Your Social Security number (no thank you)

- Or your EIN (yes, please)

If you have an EIN, that’s what goes on the W-9.

The IRS actually expects to see your name + EIN on the 1099. This is completely normal.

“Should I Proactively Send My W-9?”

Short answer: Yes.

Longer answer:

A responsible service provider doesn’t wait until January 29th when everyone’s scrambling. You proactively send your W-9 to clients so:

- Their books are clean

- Their accountant isn’t chasing paperwork

- You’re not panicking last minute

And again — this is exactly why having an EIN matters. It lets you do this without exposing your Social Security number.

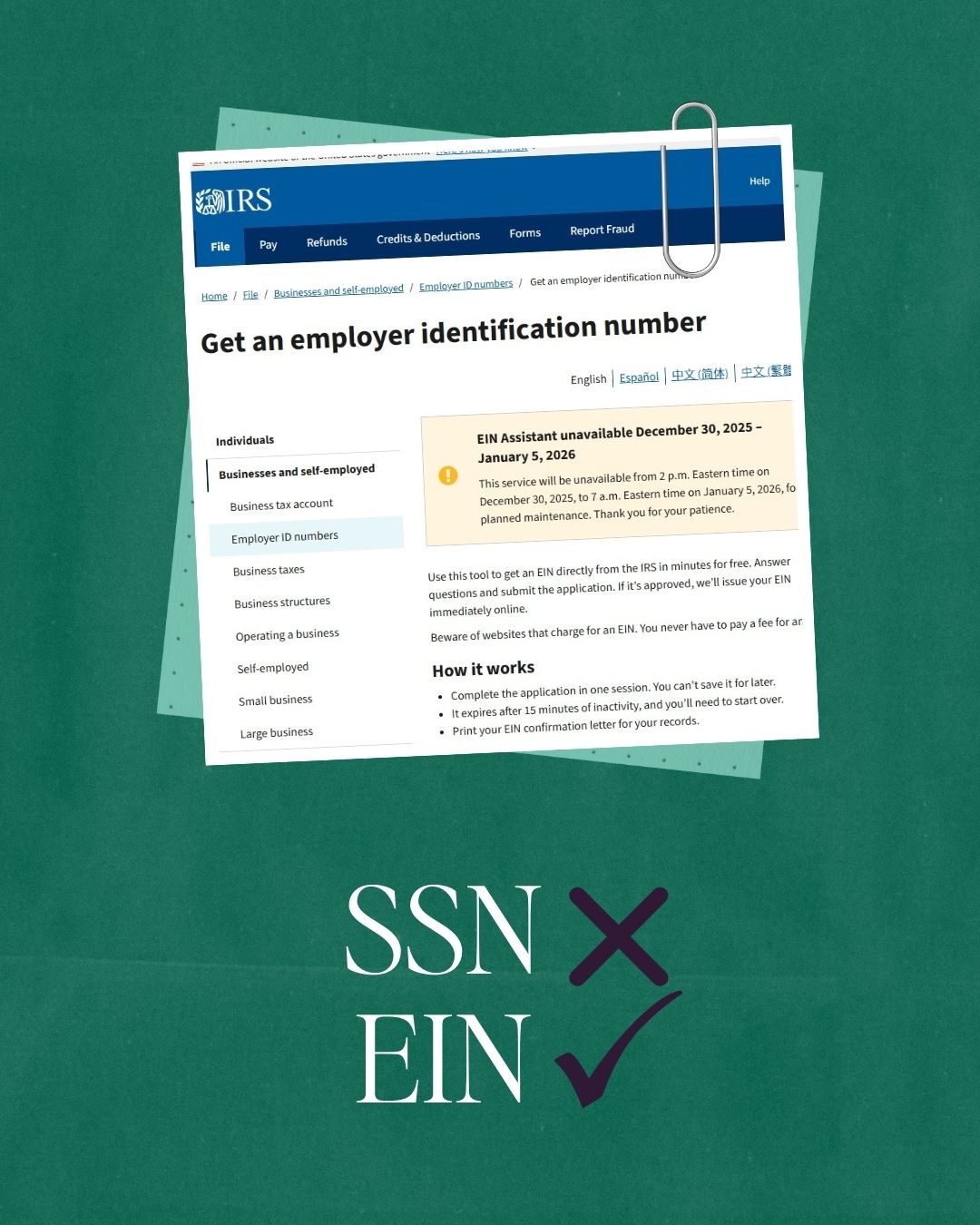

How to Get an EIN (For Free — Do Not Pay for This)

This part is important, so read carefully.

👉 The ONLY place you should get an EIN is directly from the IRS.

👉 It is FREE.

👉 Do not pay a third-party service.

There are predators out there charging $250–$400 for something that takes 10 minutes.

Here’s the real website:

https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

A few things to know:

- You can get one EIN per day per Social Security number

- The application is only available during certain IRS hours

- You’ll get your EIN immediately once completed

Pro tip from someone who’s lived the pain:

👉 Do not name multiple businesses the exact same thing in different states.

If you do, you may get stuck faxing forms to the IRS like it’s 1998.

Ask me how I know.

“But I’m Nervous About Sharing Info”

Good. You should be.

That’s why:

- You get an EIN

- You stop using your SSN for business paperwork

- You save your W-9 securely

- You send it intentionally, not reactively

This isn’t paranoia. It’s basic business hygiene.

Bottom Line

If you own a business and don’t have an EIN yet, this is your sign.

Not next quarter. Not “after busy season.”

Today.

You didn’t start your business to stress over IRS forms or data security.

I did.

Want Help Making Sure This Stuff Is Actually Set Up Correctly?

If you’re not sure:

- Whether you should be receiving or issuing 1099s

- If your W-9 is filled out correctly

- Or if your books even support what you’re reporting

That’s literally my lane.

👉 Work with Lookout Bookkeeping:

https://www.lktbook.com

👉 Grab the free resource: “Tax Planning Questions to Ask Your Accountant”

(so you stop getting vague answers and start getting clarity):

Tax Planning Questions

Comments Off on Get an EIN Yesterday: The Simple Move That Protects Your Social Security Number